How to explore the Covered California website to find health insurance options

Covered California is the state insurance exchange set up for Californians under the ACA. Here is a brief tour on how to explore your coverage options. The official web site is at: coveredca.com. When you access the site you will see this opening page:

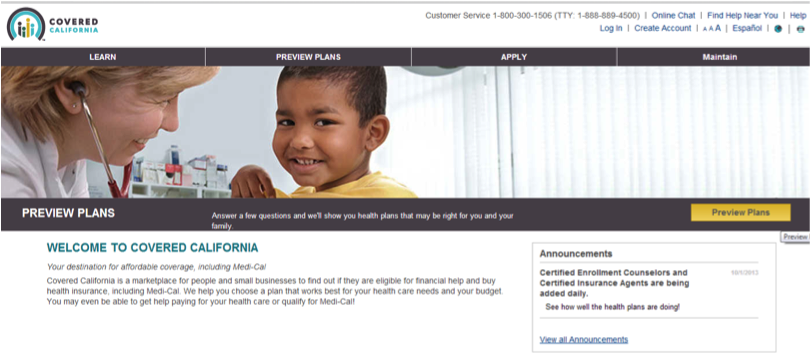

We used the tool that is available when you push the Start Here link. Note also there is a number to call directly, if you do not want to use the internet to explore your options. The next screen brings up a series of windows that ask basic information to access the plans and the costs you will pay under the plans:

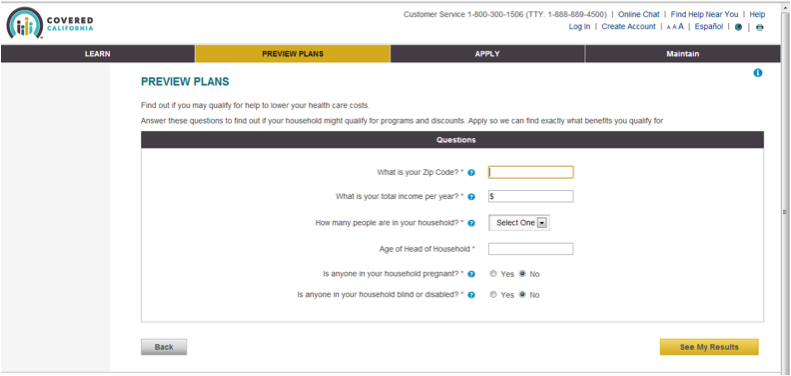

Choose the Preview Plans link. The next screen will guide you through the process of selecting plans for comparison. Enter your zipcode, your income per year (adjusted gross income), members in your household, and your age:

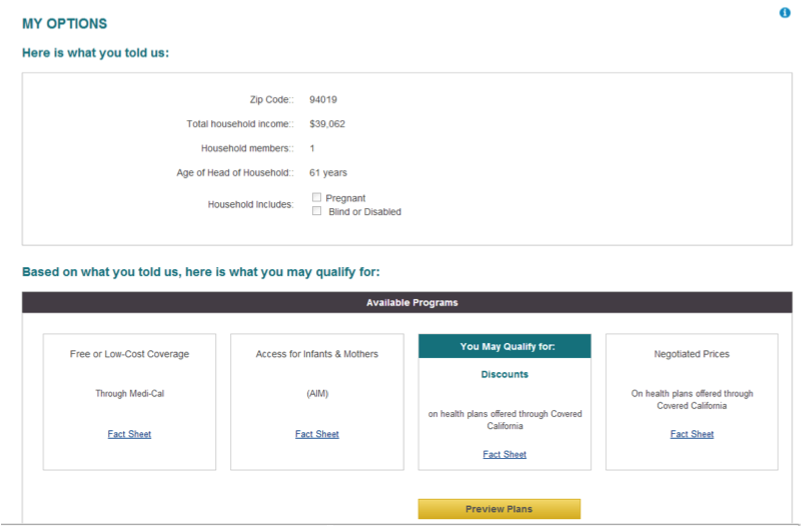

The next screen is entitled “Here is What You Told Us.” It shows the information you entered and then shows a Preview Plans link.

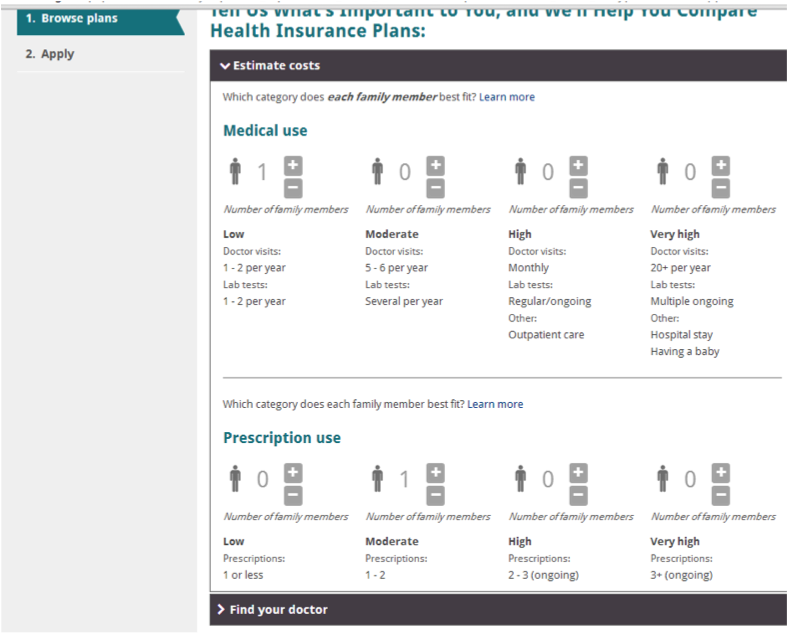

The next screen includes a cost estimator. On this screen you identify the level of medical needs for yourself and those in your household. There is a link for you to browse for you doctors also.

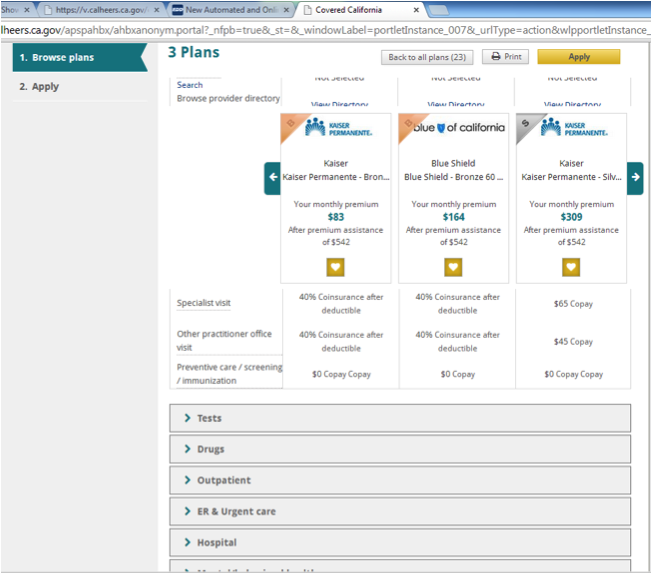

The next screen shows the plans and costs. The number of plans will vary, but there will be a sample of bronze, silver, gold and platinum plans for you to browse. The premium costs are displayed, any reimbursement assistance that you qualify for, and a selection of plans. You can browse through all of the plans by selecting the ͢ [arrow] button. There is also a Favorites link at the top, so you can select the plans you want to examine further. The screen will display up to four plans at a time.

Although we are still shopping, there was one aspect of the ACA that stood out for us. Under the new ACA-qualified plans, your maximum out-of-pocket will never exceed $6350.00 per year. There is no lifetime cap. For Lin, an older adjunct, this is huge. “If I lost my healthcare coverage, and I feel assured by the new ACA. Under the old private plans I used to purchase, I would hit that lifetime cap if I had a catastrophic medical condition or accident. I would face bankruptcy. Under the ACA, that will no longer happen. The out-of-pocket might be a drain on my savings overtime, but the lack of a lifetime cap is huge improvement for average working Americans.”

The > links allow you to expand each coverage item and compare costs (coinsurance or copays) for each plan.

Our Tips

Try your options several times, just to make sure you are getting accurate information. We also have heard that the phone assistance is quite helpful. On occasion we could not get access, possibly due to traffic or maintenance going on, but this was not a huge problem for us. We did try exploring options on wifi/public systems, and the site was a little slow. We had better luck on our home networks.