TAX REFORM & SCHOOL FUNDING

AFT 1493 supports reform of Proposition 13 to require large commercial property owners to pay their fair share

AFT Local 1493 recently passed a resolution that resolved that “the San Mateo Community College Federation of Teachers supports efforts to modify how the value of commercial properties in California are reassessed to allow for more regular commercial property value reassessment” and “that tax revenues generated by modernizing how commercial property is reassessed benefit local schools and not accrue to the State of California as General Fund savings.”

By passing this resolution, AFT 1493 has joined a growing coalition that has formed to reform Proposition 13, passed in 1978. Since that time the corporate loopholes in Proposition 13 have crippled California, decimated our education system, increased government gridlock, and created a massive handout to corporations. All of this has come at the expense of students, working families, and everyday homeowners. This new effort to reform Proposition 13 will maintain existing protections that are now provided to residential homeowners.

The plan to make Proposition 13 work for the people of California, without providing huge tax breaks for corporations is quite simple:

- Establish regular reassessment of non-residential commercial property in California. Nearly everywhere else in the country regularly reassesses commercial property every 1-5 years.

- Maintain current Prop. 13 protections for all residential property. Homeowners, home renters, apartment owners, and apartment renters will not be affected by this reform.

- Provide an exemption for small businesses. Large commercial property owners like Chevron and Disney Corporation are currently under-taxed by billions each year! These corporations would be affected by this reform, not small business owners.

- Implement this reform in a smart way. Some commercial properties have not been reassessed in 35 years, meaning they are still paying property taxes based on 1970s rates. Our reform would take this into account and gradually phase-in changes over time to make the transition as smooth as possible.

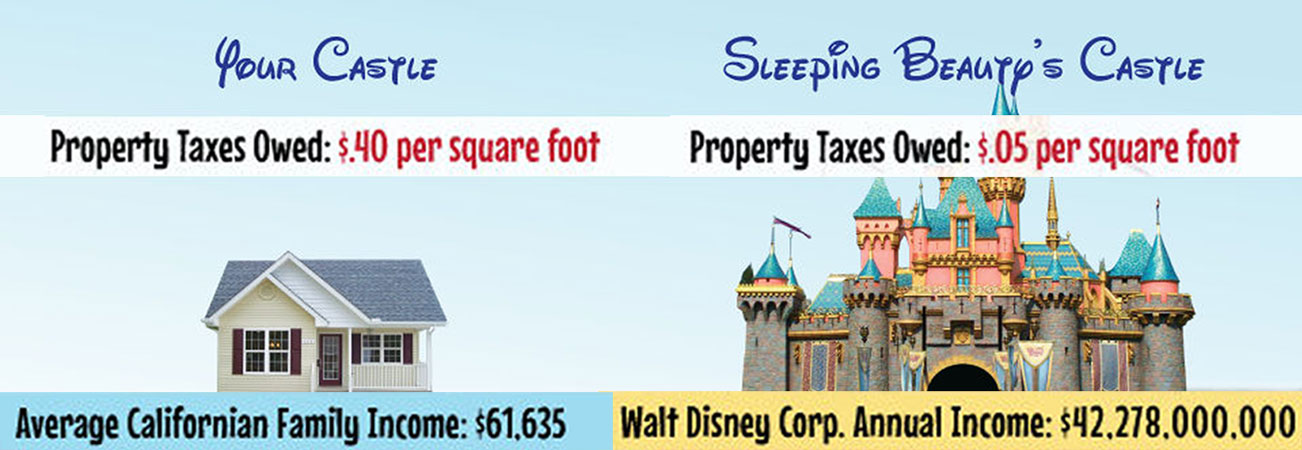

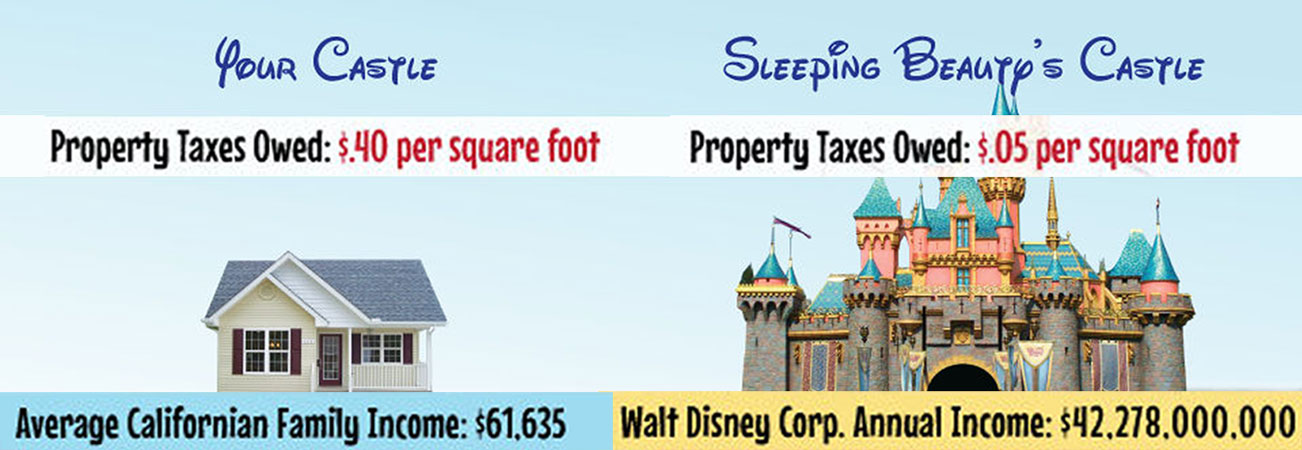

The average homeowner is paying 8 times what Disneyland pays in property taxes!

Voters passed Proposition 13 to protect your castle, not Sleeping Beauty’s castle!

This common sense reform will:

- Decrease the tax burden on working families. Prop. 13’s commercial property loophole forces our state, county, and municipal governments to raise funds in other ways. Today, California has the highest income and sales tax in the country, and local governments regularly ask voters to pass regressive parcel taxes to fund vital public services.

- Provide at least $6 billion a year of desperately needed revenue to our schools and public services. Prior to Proposition 13, California schools ranked in the top ten nationally in per pupil spending, today we rank 49th! Restoring funding to our schools is critical for the future of California and making corporations pay their fair share is the best way to do this.

- Increase California’s fiscal stability. Increased reliance on more volatile forms of taxation, like income and sales tax is bad for our economy. The property tax is the most stable form of taxation, which is why it should be a greater source of revenue for state, county and municipal governments.

- Make California’s property tax system fairer. In most counties, the property tax burden was equally shared prior to Proposition 13. Since Prop. 13 passed, the property tax burden in California has dramatically shifted from commercial property to residential property. Today, homeowners pay 72% of property taxes, while commercial Properties only pay 28%.

- Create a healthier business climate in California. Prop. 13 is anti-competitive. If a new business buys property across the street from an established business that has owned their property for longer, they are at a competitive disadvantage. Two identical businesses side by side can pay drastically different property tax rates based on when they purchased their property. This does not foster fair competition or encourage new business creation in California.

For more information, see evolve-ca.org.